Space technology is currently booming.

Breakthroughs in AI, massive demand for huge climate data sets and dramatic improvements in satellites are stimulating investor interest in an industry that has long fascinated the world’s richest people, such as Elon Musk and Jeff Bezos.

“It’s never been this big of a topic before,” Adam Niewinski, a partner at deep tech firm OTB Ventures, told Business Insider.

The numbers back this up: Venture capitalists pumped $5.3 billion into space-tech companies around the world last year, according to PitchBook, and $6.9 billion so far this year. The space-tech market itself is now worth $447 billion, up nearly 60% over the past decade, according to McKinsey.

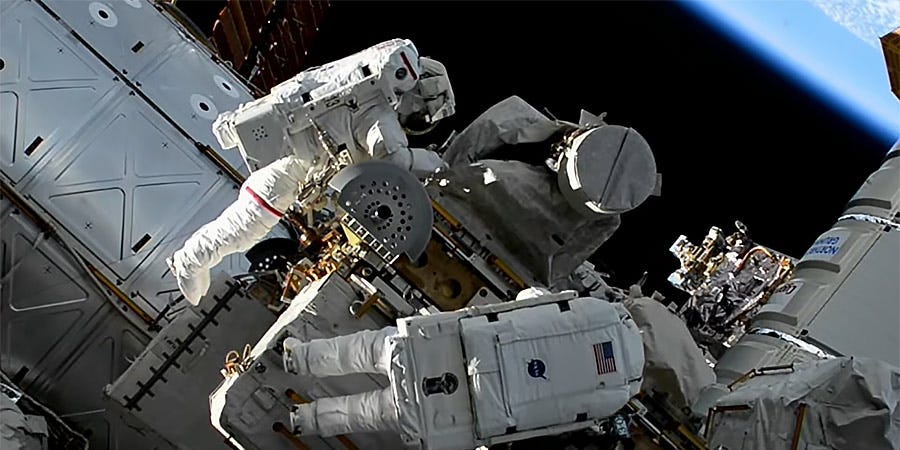

Space infrastructure companies Axiom Space and Sierra Space secured the largest funding in the space sector this quarter, raising $350 million in Series C and $290 million in Series B, respectively. The companies operate missions to the International Space Station as well as build spaceflight hardware and replacements for the ISS.

Mergers and acquisitions have also been active this year, more than double the $10 billion worth of deals that took place in 2022, according to Pitchbook. In fact, space-focused venture fund Seraphim reported that M&A activity hit an all-time high in 2023.

Investors told BI that AI’s ability to process huge amounts of data from satellites and put it to use quickly has opened up new possibilities for the sector this year.

Additionally, Earth observation satellites can be used to estimate greenhouse gas emissions, deforestation, and changes in ice and permafrost, so the need for society to rapidly decarbonize is driving interest in the industry.

Adam Niewinski (left) of OTB Ventures says excitement around space technology has never been greater.

AI’s Heavy Hand

Seraphim investor Zainab Kassim said the AI gold rush has opened up a lot of market opportunities in the space technology sector.

“The impact of AI on existing technologies used in space will undoubtedly become even greater in the coming years, enabling faster R&D execution and smarter insights for end customers,” she said.

Jeff Crusey, a partner at early-stage fund 7 Percent Ventures, said AI has a “huge role to play” in developing future climate and space technologies, adding that it is “dramatically improving the efficiency of models, saving logistics, saving fuel, and ultimately improving the environment.”

For example, Atlanta-based Danti AI raised $2.75 million earlier this year for a natural language search engine for geospatial information, a world first, according to Klussey. Meanwhile, London-based SaaS startup ClimateX uses geospatial and remote-censorship data to train its climate risk models. Around 80% of the company’s data comes from space technologies, including remote-censorship from NASA, the European Space Agency (ESA) and private satellites, according to co-founder Kamil Klussey. Whereas it previously took a week to run a risk model for one country, ClimateX can now cover an entire continent in an hour, Klussey added.

Space equipment itself is getting cheaper and more reusable, which helps, investors say. There are more satellites in low-earth orbit than ever before, and more ways to get there. There are about 7,300 satellites in orbit now, half of which are Musk’s Starlink.

But companies have struggled to make use of this data so far, investors and founders told BI.

“The ability to ingest data effectively and efficiently is now key,” said Piotr Bucanski, senior investment associate at Beringia.

The data requires pre- and post-processing, which can result in incomplete data, said Kurza of Climate X. For example, LiDAR is a data-gathering laser that is fired from an airplane. Kurza said LiDAR collects good data, but only when additional context, such as the plane’s height, is taken into account.

“The data in its raw form can’t really be used because it’s just a set of geographic coordinates and needs to be fed into a model somehow.” It also needs to be tested and validated up front.

These challenges make it difficult for companies to make sense of the data, but AI’s ability to process vast amounts of data can benefit both Earth and space exploration: ESA is exploring the use of AI to make its satellites more responsive, agile and autonomous.

Earth observation won’t be as disruptive as it has been over the past five years, according to Niewinski, who sees space servicing — extending the lifespan of satellites and safely removing failed ones — as the next frontier.

“Right now, a lot of investors are focused on putting spacecraft into orbit, and there’s a lot of investment in launch companies and providers. Nobody is really looking at the market for getting spacecraft back to earth,” added Andreas Riegler, founding partner at deep tech fund Apex Ventures. He pointed to Rocket Factory Augsburg, a German company testing inflatable re-entry vehicles, and OCAPI Orbitz, a company developing collision-avoidance software.

Indeed, the rise of such companies could help solve the thorny problem of space debris.