The International Energy Agency (IEA) has revealed that global investment in solar, wind, batteries, electrolyzers and heat pumps will rise to $200 billion (£160 billion) by 2023.

This represents a 70% increase in global investment levels in 2022, equivalent to around 4% of global GDP.

The report, titled “Advancing Clean Tech Manufacturing,” details that solar photovoltaics and battery manufacturing led global investment in clean energy, accounting for more than 90 percent of the total in both years.

Solar manufacturing investment is expected to more than double in 2023 to about $80 billion, while battery manufacturing investment is expected to grow by about 60% to $110 billion. For more details, see this article in our sister publication, PV-Tech.

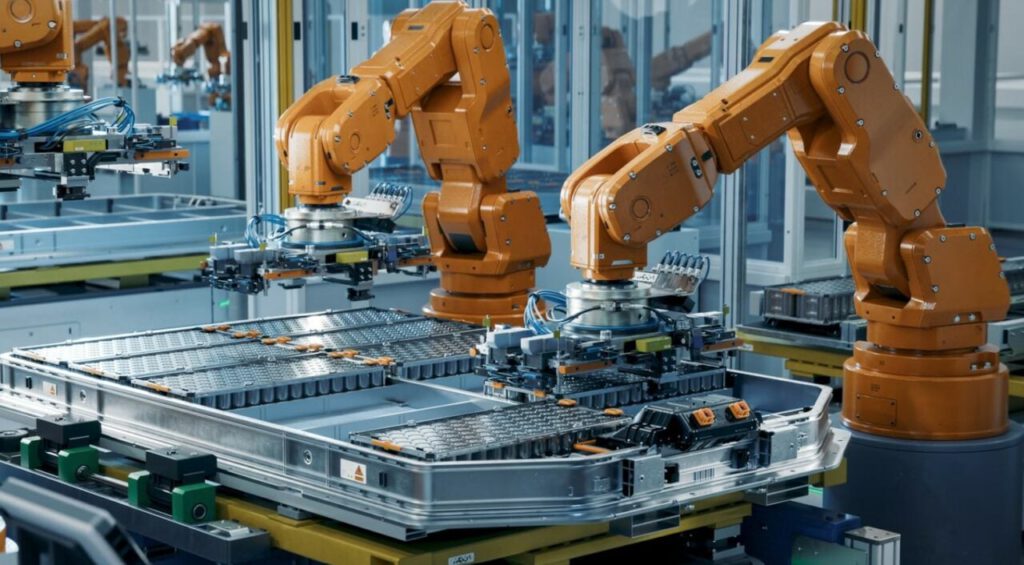

Battery storage is an increasingly important aspect of the renewable energy sector, ensuring grid stability and enabling variable generation technologies such as solar and wind to be harnessed.

According to the report, many of the projects underway will soon be operational: About 40% of clean energy manufacturing investments expected in 2023 were earmarked for facilities scheduled to be operational in 2024. For batteries, this figure rises to 70%.

Committed projects, which are under construction or due to reach final investment decision by 2025 alongside existing capacity, will exceed the world’s installed solar PV needs by 50% in 2030 and meet 55% of battery cell requirements, based on the IEA’s Net Zero Emissions by 2050 (NZE) scenario.

Battery production to hit record high in 2023

Total production of batteries used in energy storage and electric vehicles (EVs) exceeded 800 GWh, up 45% from 2022. Capacity additions also surged, with cell manufacturing increasing by about 780 GWh, about 25% above 2022. This raised total installed capacity to about 2.5 TWh, almost triple current demand.

According to the IEA report, if all announced plans are implemented, global battery manufacturing capacity could exceed 9 TWh by 2030.

In the NZE scenario, the installed battery manufacturing needs for 2030 also seem achievable, as the expansions already announced and receiving final investment decisions could meet more than 90% of the requirements.

Electrolyzer and wind power manufacturing growth slows

Wind power and electrolyzer manufacturing both grew rapidly in 2023, but the increases were less pronounced than those for batteries and solar power.

For wind power, existing capacity could meet around 50% of the 2030 NZE demand, with announced projects able to meet a further 12%. Heat pumps, on the other hand, are experiencing stagnant growth across various major global markets, with existing capacity only able to meet a third of the NZE 2030 need.

Although the increase in manufacturing will be modest, there is the potential for it to increase significantly given the ability to quickly develop new factories in tandem with capacity expansion.

The geographic concentration of manufacturing for these technologies is also expected to remain unchanged by 2030, with the majority of them to be developed in Europe, China and the U.S. Outside the major producing countries, Latin America accounts for a small share of global production of key components for wind turbines, mainly 4% to 6% of nacelles, blades and towers.

Worryingly, there is currently virtually no cleantech manufacturing in Africa, with a more pronounced focus on upstream solar PV and battery components, but in a twist, the IEA believes the prospect of spare capacity could open up the possibility of further diversification of production in this sector.

Commenting on the report’s findings, IEA Executive Director Fatih Birol said: “Record production of solar power plants and battery storage factories is driving the clean energy transition, and a strong investment pipeline in new facilities and factory expansions will add further momentum in the coming years.”

“While further investment is needed in some technologies and clean energy manufacturing could be further spread around the world, the direction is clear. Policymakers have a huge opportunity to develop industrial strategies that put the clean energy transition at their core.”