Organizations around the world rely on cybersecurity to protect themselves from hackers, and that reliance was made clear on July 19 when a software update from cybersecurity company CrowdStrike (NASDAQ: CRWD) contained an error that caused widespread disruption at many businesses, including airlines, hospitals and banks.

This unexpected event caused CrowdStrike’s stock price to plummet 11% on the day of the outage, and the stock has continued to fall since then, to below $270 at the time of writing, well below its 52-week high of $398 hit on July 9. Is this drop an opportunity to buy back shares?

Or would you be better off buying shares in CrowdStrike rival Palo Alto Networks (NASDAQ: PANW), whose stock has risen in the wake of CrowdStrike’s software update fiasco. Let’s compare the two cybersecurity companies to see which is the better investment.

CrowdStrike Evaluation

While CrowdStrike’s July 19 outage is embarrassing for the company at this point, a more important investment decision is how the company performs over the long term. Given its performance so far this year, investors with a long-term perspective could take advantage of the current share price crash to buy the stock.

One reason is CrowdStrike’s strong revenue growth, which came in at $921 million in the first quarter ended April 30, up 33% from a year ago.

CrowdStrike’s revenue growth is driven in part by customers adopting multiple of its cybersecurity solutions. The company’s software platform offers a variety of add-ons beyond basic monitoring, such as asking security personnel to proactively look for cyberthreats. In the first quarter, 65% of customers adopted five or more of these add-ons, and deals with eight or more add-ons grew 95% year over year.

In addition to impressive revenue growth, CrowdStrike is also in strong financial shape: the company delivered record free cash flow (FCF) of $322 million in the first quarter, up 42% year over year.

The company ended the first quarter with a strong balance sheet: total assets of $6.8 billion, with cash and cash equivalents alone accounting for $3.7 billion.

Total liabilities were $4.3 billion, of which $3.1 billion was deferred revenue. Deferred revenue represents payments received from customers that will ultimately be recognized as revenue as CrowdStrike fulfills its contractual obligations.

Palo Alto Networks Case Study

CrowdStrike’s performance so far has been strong, but so has rival Palo Alto Networks, which saw revenue grow 15% year over year to $2 billion in the third quarter that ended April 30.

The story continues

Additionally, third quarter FCF increased to $492 million from $401 million a year ago. The company ended the third quarter with a very strong balance sheet with total assets of $17.9 billion and cash and cash equivalents of $1.4 billion. Total liabilities were $13.5 billion, of which $10.2 billion was deferred revenue.

As part of its expansion plans, the company introduced a new strategy this year that encourages customers to consolidate their multi-vendor cybersecurity spending onto Palo Alto Networks, and so far, the strategy appears to be working.

In the company’s third quarter, the number of accounts spending more than $1 million at the company increased 22% year over year, and the number of accounts spending more than $10 million increased 28% year over year.

CEO Nikesh Arora noted that a company dissatisfied with its existing cybersecurity vendor chose Palo Alto Networks because of the company’s “integrated capabilities delivered through our six-part platform.”

Choosing CrowdStrike or Palo Alto Networks

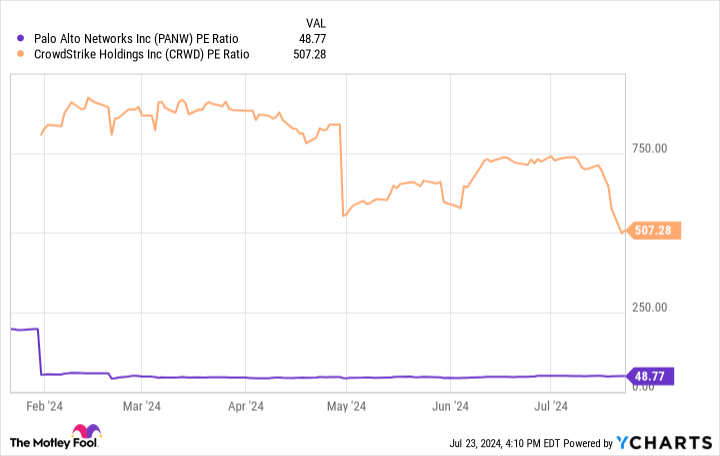

Both CrowdStrike and Palo Alto Networks have had great performances this year, so another factor to consider when deciding between these two stocks to buy is valuation, with the price-to-earnings ratio (P/E ratio) being a commonly used metric for this.

PANW PE Ratio Chart

CrowdStrike’s P/E ratio is roughly 10 times that of Palo Alto Networks, even after the stock price fell following the July 19 outage, suggesting that Palo Alto Networks stock is more valuable.

Palo Alto Networks stock, combined with favorable fiscal 2024 earnings and valuation, makes it an attractive investment. Additionally, the long-term impact of CrowdStrike’s failed software update remains unclear at this time.

As a result of the July 19 outage, some Wall Street analysts have downgraded CrowdStrike’s stock, with Guggenheim’s John DiFucci, for example, saying that “the global disruption caused by CrowdStrike will likely have a negative, even temporary, impact on the company’s business.”

DiFucci has a point: Tesla CEO Elon Musk announced that the company had stopped using CrowdStrike after the software issues arose.

Taking all these factors into account, Palo Alto Networks is currently the better stock to buy in the cybersecurity giant race.

Should you invest $1,000 in CrowdStrike right now?

Before you buy CrowdStrike shares, consider the following:

The analyst team at Motley Fool Stock Advisor has identified the 10 best stocks for investors to buy right now, and CrowdStrike was not among them. The 10 selected stocks have the potential to generate big gains over the next few years.

Consider the date when Nvidia made this list: April 15, 2005… If you had invested $1,000 at the time of recommendation, you would have made $692,784!*

Stock Advisor gives investors an easy-to-follow blueprint for success, with portfolio construction guidance, regular updates from analysts, and two new stock picks every month. The Stock Advisor service has more than quadrupled S&P 500 returns since 2002*.

View 10 stocks »

*Stock Advisor returns as of July 22, 2024

Robert Izquierdo has invested in CrowdStrike, Palo Alto Networks and Tesla. The Motley Fool has invested in and recommends CrowdStrike, Palo Alto Networks and Tesla. The Motley Fool has a disclosure policy.

Better Cybersecurity Stocks: CrowdStrike vs. Palo Alto Networks was originally published by The Motley Fool.