(Bloomberg) — This year has been a testament to Elon Musk’s ability to plunge Tesla Inc.’s stock into and out of peril.

Most read articles on Bloomberg

It’s been a turbulent time even by Tesla standards, with the CEO fighting for control of the company, halting the release of a $25,000 electric car, and ordering mass layoffs. These turbulent events caused Tesla’s stock price to plummet 43% as of April 23, the last time the company reported earnings.

Since then, despite declining expectations and lackluster results for Tesla’s second-quarter earnings, due to be released on Tuesday, the company’s shares have soared, with none other than Musk at the helm, boosting Tesla’s market capitalization by more than $386 billion in just 11 weeks.

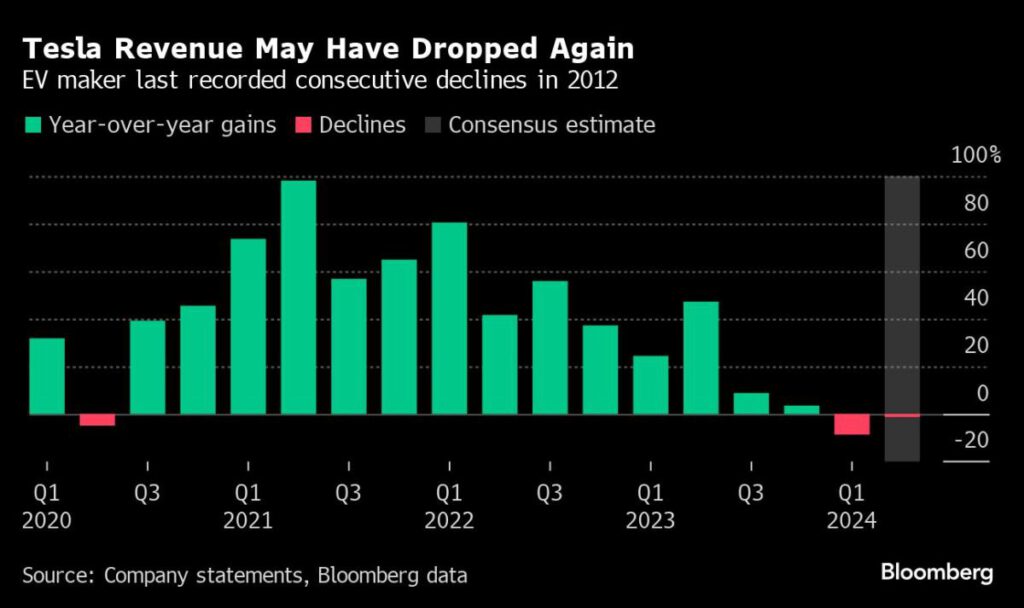

The CEO has successfully shifted investors’ attention from current sluggish sales and profits to Tesla’s potential in a future dominated by artificial intelligence. His keen sense of what the market wants to hear and his relentless salesmanship will be put to the test after the close, when the company is likely to report its second consecutive quarter of declining sales and fourth consecutive quarter of declining profits.

“What will really change Tesla’s valuation is Musk’s ability to convincingly position the company as a leader in AI and self-driving technology,” said Adam Sirhan, founder and CEO of 50 Park Investments. “This narrative shift is crucial in justifying Tesla’s premium valuation compared to traditional automakers.”

Tesla’s stock price has long been unpredictable, driven by its CEO’s charisma and controversy, and investors appear to be bracing for more of the same ahead of the company’s next earnings report.

Options trading suggests the company’s shares could move as much as 8% in either direction from its second-quarter results, and Musk is likely to address further a Bloomberg report on July 11 that the company had delayed the unveiling of its robotaxi prototype from August.

Musk acknowledged that he had asked for “significant design changes” to the front of the vehicle, but did not provide details about what those changes were or how much extra time it took to prepare the vehicle.

“Tesla’s second-quarter results will be a tough call for investors as there are a lot of variables at play,” said Tom Narayan, an equity analyst at RBC Capital Markets who has a buy recommendation on the stock. “Part of this movement is likely related to the upcoming robotaxi event. We hope that will help change our view on the stock and are strong believers in this thesis, but we question how much is already priced in.”

The story continues

Musk sparked a rally in Tesla shares when he announced in the first-quarter earnings call that the company would bring forward the introduction of new models, including more affordable cars, to as early as later this year. The company had previously said it planned to start production of its next-generation electric car in the second half of 2025.

The CEO was mum on details about those vehicles, but also drew a line, telling investors not to bet on Tesla shares unless they believe the company has “solved” self-driving technology.

Tesla shares are trading at about 94 times forward earnings, a sign that many believe Musk will eventually deliver on his predictions of self-driving cars. By contrast, General Motors Co. and Ford Motor Co. trade at mid-single digits.

But Musk’s aggressive push to pin Tesla’s fortunes on self-driving cars has had a downside: When Bloomberg reported this month that the company’s robot-taxi launch would be delayed until October, the company’s shares fell 8.4%, its biggest one-day drop since January.

“The sell-off we saw when Musk postponed the event suggests that much of the recent rally was AI-related,” said Seth Goldstein, equity strategist at Morningstar.

Analysts’ average forecast for Tesla’s second-quarter profit is about half what it was a year ago, but estimates have risen slightly over the past month, likely as a result of better-than-expected car sales announced on July 2. The company is now expected to report profit of 58 cents per share and revenue of $24.1 billion, according to data compiled by Bloomberg.

While many analysts point to Tesla’s AI potential as the biggest driver of the stock, investors are still hoping Musk can restore growth in the electric vehicle business while engineers work on self-driving technology. Tuesday’s earnings will shed light on how the company is executing on those short- and long-term goals.

“Tesla has the key attributes to be valued as a company that will benefit from AI, but its auto earnings downgrades need to stabilize first,” said Morgan Stanley’s Adam Jonas, who has a buy rating on the stock.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP