Investors with big money are getting bullish on Moderna (NASDAQ:MRNA).

Retailers should know.

I noticed this today when a trade appeared in the public options history we’re tracking on Benzinga.

We don’t know if these are institutional investors or just wealthy individuals, but something this big happening at MRNA means someone knows something is about to happen.

So how do we know what these investors have done?

Benzinga’s options scanner discovered eight unusual options trades for Moderna today.

This is not normal.

The overall sentiment of these large traders is split with 37% bulls and 37% bears.

Of all the special options we found, there were four put options with a total value of $167,740 and four call options with a total value of $158,137.

Expected price range

Analyzing the trading volume and open interest of these contracts, it appears that major players have been looking at a price range for Moderna between $80.0 and $170.0 over the past quarter.

Trading volume and open interest trends

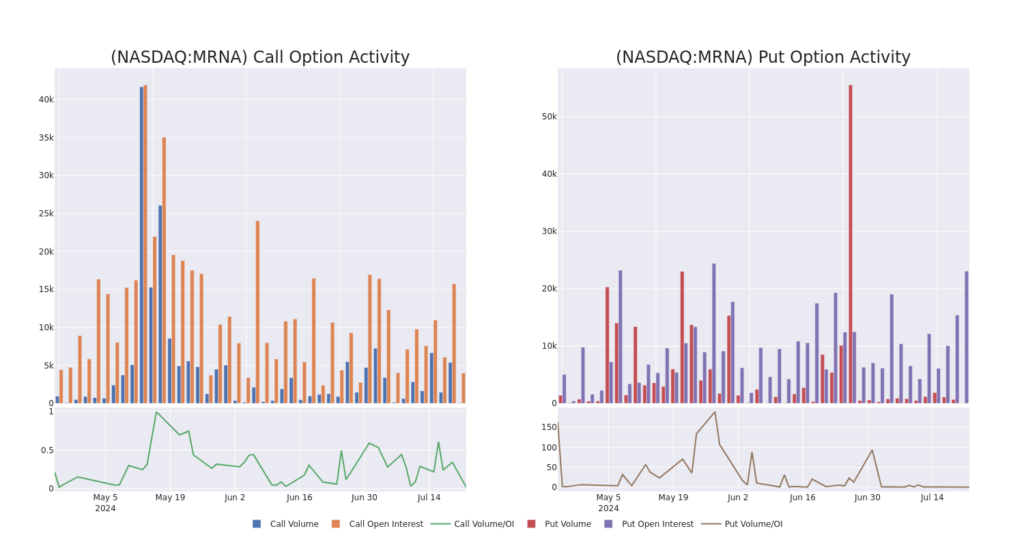

When trading options, it’s useful to keep an eye on volume and open interest. This data helps us track the liquidity and interest in Moderna options at specific strike prices. Below we can see the volume and open interest trends for calls and puts, respectively, over the past 30 days for all Moderna whale trades with strike prices between $80.0 and $170.0.

A snapshot of trading volume and interest in Moderna 30-day options

The biggest options found are:

Symbol PUT/CALL Trade Type Sentiment Exp. Date Sell Buy Price Strike Total Traded Price Open Interest Volume MRNA Call Sweep Bearish 01/17/25 $7.45 $7.05 $7.1 $170.00 $62.4K 2.0K 1 MRNA Put Sweep Bullish 01/17/25 $8.6 $8.4 $8.45 $100.00 $59.9K 3.7K 6 MRNA Put Sweep Bearish 01/17/25 $10.7 $10.35 $10.5 $105.00 $39.9K 18.9K 16 MRNA Put Trade Bearish 01/17/25 $36.05 $35.25 $35.85 $150.00 $35.8K 403 0 MRNA Call Trade Neutral 08/30/24 $45.5 $39.0 $42.78 $80.00 $34.2K 0 0

About Modena

Moderna is a commercial-stage biotechnology company founded in 2010 and held an initial public offering in December 2018. The company’s mRNA technology was rapidly validated in a COVID-19 vaccine that was approved in the U.S. in December 2020. Moderna has 39 mRNA development candidates in clinical trials as of mid-2023. The programs span a wide range of therapeutic areas, including infectious diseases, oncology, cardiovascular disease and rare genetic disorders.

After thoroughly researching the options trading surrounding Modena, we will then conduct a more in-depth study on the company, which will include an assessment of the company’s current market situation and performance.

Moderna’s current market situation

Trading volume was 479,731, with MRNA’s price dropping -0.24% to $120.85. The current RSI reading indicates that the stock may be nearing oversold status. The next earnings report is due in 10 days from now.

Options trading involves higher risks and potential rewards. Smart traders manage these risks by continually self-educating themselves, adapting their strategies, monitoring multiple indicators and closely watching market movements. Stay up to date on the latest Moderna options trades with Benzinga Pro’s real-time alerts.