On the surface, most Israeli tech companies, big and small, were taking care to support their customers and post diplomatic LinkedIn messages offering concrete solutions for rebooting computers in the midst of a shocking global crash. But behind closed doors, a good number of champagne bottles were being popped.

4 View Gallery

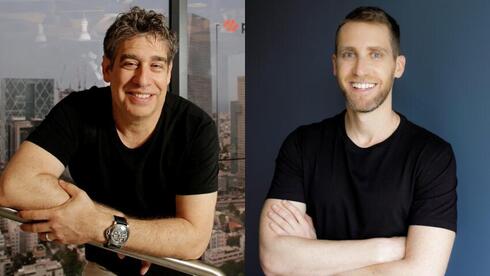

Palo Alto Networks founder Nir Zuk and Wizz founder Assaf Rapaport

(Photos: Ryan Froese and Omar Hacohen)

CrowdStrike may be an unfamiliar name to many, but it is a darling of the global cybersecurity market and the toughest rival to almost all Israeli cybersecurity companies.

CrowdStrike is a name synonymous with cybersecurity success. The company finished 2024 (ending January 2024) with $3 billion in revenue and $1 billion in cash flow, numbers reminiscent of Check Point, but growth is accelerating and the company is on track to bring in about $4 billion in revenue this fiscal year. Before Israeli company Wiz came on the scene, CrowdStrike dominated the cybersecurity industry’s name recognition.

For Israel’s cybersecurity industry, CrowdStrike’s troubles are an opportunity: CrowdStrike is a major competitor to Israeli company Palo Alto Networks, and is similar in size and goal to build a comprehensive platform that meets all of an organization’s cybersecurity needs.

The specific issue that took down Windows-based computers around the world over the weekend was linked to the ENDPOINT product, which stands for endpoint protection, and is a major competitor to Palo Alto’s Cortex product and SentinelOne’s Israeli-developed platform.

But for CrowdStrike, which started out with endpoint protection most similar to old antivirus software, and now rolls out everything under the Falcon brand, it has been associated with serious errors that it caused.

4 View Gallery

CrowdStrike Offices

(Photo: Google Maps)

The company also offers cloud security solutions that compete with Wiz, Orca, Palo Alto’s Prisma, and Check Point’s CloudGuard. The impact of the crisis on publicly traded companies such as Palo Alto and SentinelOne is reflected in the rise in their stock prices, in contrast to the fall in CrowdStrike’s stock price. The impact on privately held companies was less severe.

But the emotional appeals put forth by startups like Orca, DAZZ, and even Zafren are essentially declarations of “we are here and ready to offer you an alternative solution.”

CrowdStrike’s collapse comes at an interesting time for the cybersecurity market, which has seen a consolidation frenzy for about a year since Palo Alto, which has surpassed CrowdStrike in both valuation and revenue, began pushing its comprehensive platform initiative.

The logic behind this is clear: cybersecurity managers at organizations are fatigued with dozens of different pieces of software to manage, and would prefer to move to one comprehensive solution that may not offer the highest quality in all security areas, but is sufficient for most security areas.

Within this framework, CrowdStrike has also become a significant acquirer, acquiring two Israeli startups last year for a combined total of $500 million.The incident exposes the downside of relying so heavily on a single supplier that can make a single mistake and still ship.

4 View Gallery

Windows Errors Caused by CrowdStrike’s Platform

CrowdStrike’s share price fell on Friday, not just on investor anger but also on expectations that potential customers will turn to rival suppliers, with Israeli companies entering the market stronger than ever.

The market may once again favor small startups, a niche market for Israeli organizations. It was very surprising to see how much Israeli institutions were affected by the CrowdStrike glitch, but this may be an opportunity to change the situation with an Israeli product.

Beyond the business rivalry, CrowdStrike has become part of the exit strategy for many Israeli cybersecurity startups: With $4 billion in reserves and aspirations to expand its solutions portfolio, the U.S. company has become a target for Israeli venture capital funds looking for buyers for their products.

To demonstrate to investors and customers that it is committed to improving its platform and to communicate its “business as usual” approach, CrowdStrike may make further acquisitions in the near future, making Israel an attractive development location.

4 View Gallery

With

(Photo: Brandon LaKane: Lucky Shot Media – Courtesy of Wiz)

Nor can we ignore the impact the weekend’s events have on Wiz’s ongoing deal with Google. While the error didn’t occur in an area where Wiz competes with CrowdStrike, the glitch made clear just how centralized Microsoft’s cybersecurity is and how the world depends on it.

Google shareholders may have thought earlier this week that paying $23 billion for an Israeli company was too expensive, but the company has now demonstrated that it has the potential to make inroads into Microsoft’s market – as long as it has better cybersecurity solutions.